By Henrik Moller, Carsten Dortans and Janet Stephenson.

About one-half of New Zealand’s early adopters of electric vehicles (EVs) bought them mainly for environmental reasons. But it’s important to not typecast all EV owners as “Greenies”, or presume that they are making some personal sacrifice to save the planet by driving electric.

One EV owner told us that he immediately stripped the ‘Zero Emissions’ signage off his new Nissan Leaf because “no one was going to call me a Greenie”.

Flip the Fleet’s surveys show that around one-third bought mainly because of the EV’s low running costs. Others were attracted by the comfortable and quiet ride, smart technology, or fast pick-up. Some prioritised safety.

No matter what the primary reason for making the switch, the new owners often find themselves becoming more environmentally conscious in more than just their vehicle choice – they start conserving household energy use, reduce waste, and some even fly less. For others, their sustainability journey was already well underway before buying an EV as the next stage of deepening their commitment to more sustainable lifestyles.

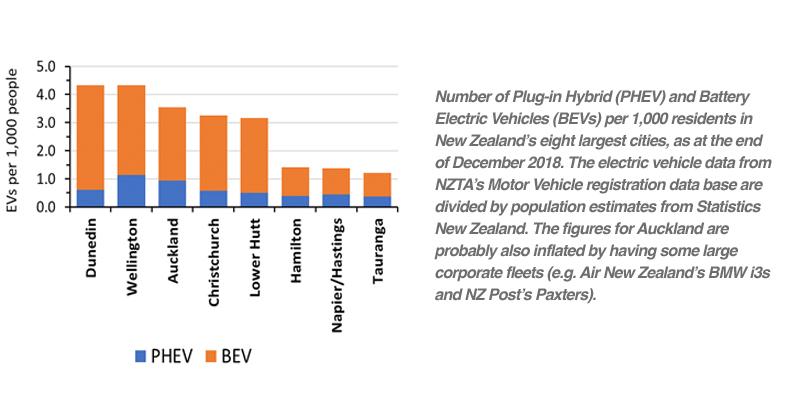

Whatever people’s primary reason to switch, there are other factors at play that influence EV adoption rates. Fastest uptake has been in Dunedin, followed closely by Wellington, judging from the number of electric vehicles owned per 1,000 residents (Fig. 1). The smaller cities are lagging. Probably the differences partly reflect visibility and gathering momentum.

We see an amazing number of Leafs driving round Dunedin these days compared to just a year ago – the more people see EVs on the road, the more normal they seem, and the more confident new buyers can feel about them. But something got places like Dunedin and Wellington snowballing earlier than elsewhere. We think it is partly because of the amazing local EV support groups there who have stepped up to give punters test drives, answered their queries and supported their local EV dealers to invest more.

You might think that Auckland would have been leading in view of the large number and early arrival of public rapid chargers and a relatively large number of wealthy families that can more easily afford the higher purchase cost of EVs.

Also, a supreme advantage of EVs is their increased efficiency in urban areas – if you are stuck in a traffic jam in an EV you are spending next to nothing in battery power compared to sitting in an internal combustion engine vehicle (ICVs). The average consumption of petrol or diesel per km increases by about half when driving in towns. It’s the reverse pattern for EVs – Flip the Fleet data shows that km travelled per kWh of stored battery energy in a Battery Electric Vehicle (BEV) declines by around 17 percent when the average speed of the vehicle increases from 30 km/h to 80 km/h.

Overall, both companies and individual owners in our larger cities are buying more BEVs than PHEVs (Fig. 2). However, companies are choosing to buy relatively more PHEVs than individual owners. It may be that the flexibility of PHEVs better meets business needs, or that the higher maintenance and fuel costs of PHEVs is less of a concern because they are tax deductible expenses.

On the other hand, the way Fringe Benefit Tax is structured puts BEVs at a disadvantage. There is also an embedded culture of businesses to buy new vehicles and on-sell them within 3-5 years, whereas households are content with second-hand vehicles, and keep them for longer.

So far there has been a critical lack of supply of affordable new EVs in New Zealand and second-hand imports have filled the gap, especially for individual owners. The situation is changing fast, with lots more new PHEVs becoming available in New Zealand, BEVs becoming more affordable, and practical (their range is rapidly increasing), and confidence is building in the new BEV technology and its servicing support.

The next big breakthrough in EV uptake will be the arrival of affordable, medium-range, light commercial vans and trucks to support our local commerce.

Ultimately, we still need more data to estimate total cost of ownership of both new and second-hand BEVs and PHEVs in New Zealand so that businesses and individual owners can make the smartest decisions for their own circumstances.

At the moment it’s hard to predict the resale value of the BEVs and PHEVs in a rapidly escalating market. What might a business get for selling a BEV with depleted battery health and range? Will the servicing industry to refurbish their batteries, or put in an entirely new battery into the car, be available by the time the owner needs to upgrade to the newer, even smarter EVs that are about to flood the market?

The authors of this month’s EValuation are from The University of Otago’s Centre for Sustainability. Henrik Moller is co-founder of Flip the Fleet (www.flipthefleet. org), a coalition of over 1,450 EV owners from throughout New Zealand that share data on their vehicle’s performance and their mobility patterns.