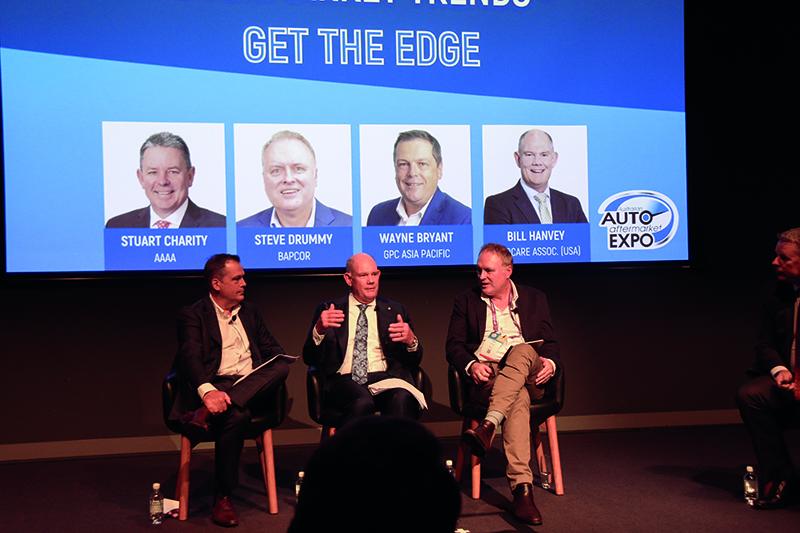

This was one of the business training seminars held at the recent Australian Auto Aftermarket Expo. It was hosted by a panel of four, Stuart Charity CEO of the AAAA, Wayne Bryant CEO of GPC Asia Pacific, Bill Hanvey CEO of the Auto Care Association (USA) and Steve Drummy Executive GM – Trade from Bapcor.

Some of the significant trends covered were the current macro-economic environment, the increase in vehicle technology and data, and the impact of technology on skills shortages.

Macro-economic trends

Around the world there are:

• More cars on the road.

• The average car parc age is increasing.

• The average annual mileage is increasing.

All of these tend to be positive for vehicle servicing although currently in Australia the average $ per job is down due to the restrained economy. The aeging vehicle parc aids aftermarket repairers as the OEM’s generally look to supply parts primarily to vehicles up to ten years of age (In USA the average age is now 12 years).

Technology in vehicles

The increase in technology aids the manufacturers in retaining service work and they are looking to extend warranty periods and add service plans to more securely lock in the first 3-5 years of servicing.

Most new vehicles now include a degree of telematics, which once it is fully implemented will enhance the OEM’s view of vehicles and potentially let owners book servicing directly from the vehicle and allow OEM’s to predict next service timing (This technology is in many new vehicles in Australia but is not currently live).

Some of the new technology will require significant investment in equipment and training to service as they flow through to the aftermarket. One example is ADAS calibration which requires its own area with floors much more level than a typical workshop and some quite expensive equipment. This might mean some repairers could specialise in this area and subcontract to others in the local area. Likewise, some EV diagnostic tools are very expensive, one we saw in a seminar was AUD$17,000. There is a membership group in Australia where you can hire the equipment when needed rather than buying it as it would only be needed infrequently.

Having good systems in your business will help as data is becoming king so some form of workshop management software will become more and more critical.

Technology and skills shortage

It is estimated Australia is currently 30,000 technicians short, which equates to around one per workshop – if NZ follows that ratio we will be around 8,000 short! The increasing technology requires higher skills and training. The effort to get more recruits starts at school with a need to get students to consider the career, individual businesses can get involved by reaching out to local schools to present at career days or open their business up for visits. Increasing the number of female trainees would also be a good option with only around 17 percent currently female leaving a large untapped talent pool, but this also needs some attitude change in the workplace to make it a more comfortable environment.