Digital car keys offer automotive Original Equipment Manufacturers (OEMs) a powerful way to showcase their digital capabilities, providing customers with seamless, value- added vehicle access and passive start features. Global technology intelligence firm ABI Research forecasts shipments of vehicles with digital car key technology to grow at a strong CAGR of 17.2 percent from 2024 to 2031, reaching nearly 60 million vehicles by the end of the forecast period. These keys can be enhanced with new features over time, enabling OEMs to drive ongoing revenue through optional upgrades that require a subscription. OEMs often enable digital key features for free for the first year of ownership, then charge annually after the trial. However, OEMs must carefully choose the right technologies suited to different regions and price segments to maximize revenue potential.

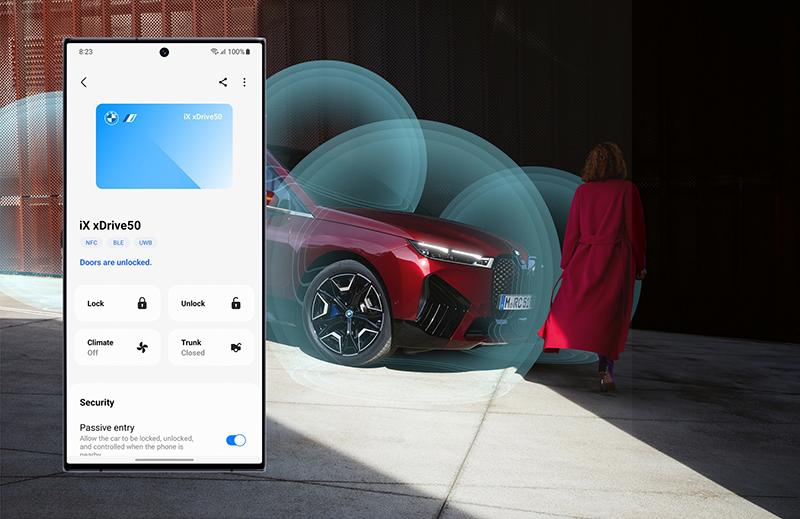

“For example, Ultrawideband (UWB) technology for digital car keys provides drivers with precise positioning and passive unlocking of the vehicle, albeit for a higher price tag for the UWB chipset and accompanying anchors in the car,” explains Abu Miah, Smart Mobility & Automotive Analyst at ABI Research. “For premium vehicle lines, UWB should still be a no- brainer, as the security advantages it provides over other technologies, such as Bluetooth Low Energy (BLE) or Near-Field Communication (NFC), are must-haves for drivers of higher-end vehicles that are more commonly the target of theft through relay attacks. In more affordable models, the price tag of UWB may not be worth the investment.”

BLE and NFC combination solutions and BLE, NFC, and UWB combination solutions are the fastest growing in the market, with a CAGR of 14 percent and 34 percent, respectively, with the difference arising because of the relatively early stage in the market for UWB solutions. Digital car key solutions are expected to reach 70 percent of vehicle shipments globally by 2031, rising from just 22 percent in 2023. More and more OEMs are shipping all of their vehicle lines with some sort of digital key functionality, with several also including UWB support in their top-of-the-line models in the last year, such as BMW, Kia, Mercedes-Benz, and Hyundai. These companies are supported in deployment by their Tier One suppliers, chipset suppliers (such as NXP), and often digital key specialists for both the hardware and cloud platform infrastructure (such as Thales, WirelessCar, and Giesecke & Devrient).

The industry has begun to unify around open standards bodies for digital keys, such as the Car Connectivity Consortium (CCC), Intelligent Car Connectivity Ecosystem Alliance (ICCE), and Intelligent Car Connectivity Open Alliance (ICCOA). Looking to the future, these open standards will play a key role in enabling the industry to move forward with digital key adoption, and nearly all OEMs are moving in this direction, apart from Tesla and some Chinese OEMs who value the quicker time-to-market that proprietary approaches allow.

These findings are from ABI Research’s Automotive Cyber Security: Securing Vehicle Access application analysis report.