They may not be ubiquitous yet, and the day-to-day advantages that they will start to provide may not be noticeable, but automated technologies across the automotive industry are starting to come of age. The ‘robotaxi’ industry is beginning to see more small commercial deployments. Autonomous trucks are on the cusp of real-world use, and next-generation sensor technologies are being deployed on vehicles that are for sale. This article covers some of the most exciting developments and milestones over the last year and makes predictions about what might come next year.

Robotaxis services starting to come online

The biggest news from this year in the world of robotaxis is commercial services have come online in San Francisco. This is a major milestone that the industry has been working towards for some time, but it is unfortunately not as exciting as it initially sounds.

People may think they can now turn up in San Francisco and hop into a driverless robotaxi without a second thought. While this may be true on paper, it is quite limited in practice. Only 30 vehicles, out of Cruise’s fleet of approximately 150 vehicles, are allowed to be used. The vehicles are limited to 30mph, the service can only operate between 10 pm and 6 am, and only a small part of the city can be used – not the transportation revolution hoped for, but a step in the right direction.

roboshuttles Struggling to Get a Foot Hold

This new and exciting future mobility solution is fast becoming not so new, not so exciting, and possibly soon confined to history. The concept of a roboshuttle-powered future is that these small, shared vehicles will be able to operate more flexibly than a bus. Thus, offering more diverse routes and some working on an on-demand basis.

These vehicles first emerged decades ago but were restricted to running on isolated roads with embedded guidance systems. From a functional perspective, they were comparable to a very cheap but slow autonomous train with very limited capacity. The modern open-road version has been around since the early 2010s. The pioneers in this industry are EasyMile and Navya, two French companies with similar vehicles and funding of around EUR€100 million each. Over the years, they have supplied around 200 vehicles each to different companies, transport agencies, and other mobility stakeholders that are interested in trialling the technology. The problem is that after many years of trials, they appear no closer to deploying a commercial, fully developed, roboshuttle service. Even more concerning is that interest in these vehicles seems to be on the decline, with the number of companies actively working on roboshuttles appearing to have peaked. IDTechEx believes these vehicles have major hurdles and fundamental flaws that need to be overcome for them to prosper.

Roboshuttles will share the challenge of robotaxis in proving that the autonomous technology is mature enough to be trusted with the lives of its passengers. On top of this, they also battle more fundamental regulations governing what constitutes a road-worthy vehicle. This is the problem of homologation. The problem is that in most regions, a vehicle needs a long list of features and engineering criteria to be signed off as road worthy. This list includes things like seat belts, a minimum number of wheels, brakes, lights, etc., – things that make cars safe. But roboshuttles tend to be missing some key features from this list since they have been designed from the ground up to be driverless. The most obvious omissions would be the steering wheel, pedal controls, rearview mirrors, and speedometer. This creates friction. Even if the autonomous technology could be 100 percent signed off today, the rules of the road would still likely prohibit these vehicles from being commercially used.

Autonomous trucks, the new juggernauts of automated vehicles

Autonomous trucks have quickly become one of the most exciting autonomous prospects over the past year. One of the key developments and milestones in the field occurred last year in December when field leader TuSimple completed an 80-mile journey across Arizona with an empty cabin and zero human intervention.

The reason to get excited about this is all the conditions are right for this industry to explode in the coming years. Firstly, there is a measurable and known driver shortage in the US, Europe, and China. A few factors drive this, key ones being: an aging driver population without the necessary pipeline of replacements, the massive growth in e-commerce, and the need for more freight on the road. Secondly, there is a significant overlap between the capability of today’s autonomous technology and the demands of the environment that the vehicles will operate in. The first deployments will likely be between distribution hubs separated by vast stretches of interstate. This eliminates lots of the more challenging scenarios for autonomous vehicles, such as pedestrians, stop signs, un-protected left turns, turning right on red lights, and other situations which rely on human judgment. Finally, autonomous trucks can bring a significant increase in productivity. Many of the journeys across the US take several days for humans to complete due to daily driving time limits. Autonomous vehicles will not be subject to this and have the potential to halve the delivery time for journeys over a certain distance. There is a need to increase fleet capacity, which driverless trucks could do. The operational design domain is within reach of what autonomous technologies can achieve, and there is the prospect of significant productivity uplift per truck with autonomy. It looks like the stars are aligning for autonomous trucks, and IDTechEx is expecting to see announcements of the first commercial ‘driver-out’ routes coming online in the next one to two years.

Another exciting year for automotive radar

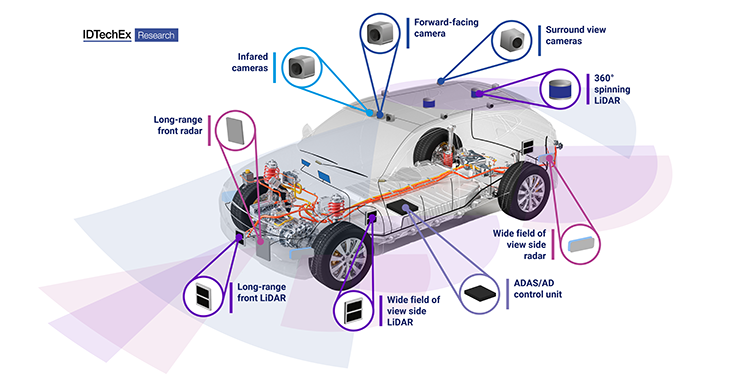

The big news in the world of automotive radar is that consumer vehicles began shipping with next generation 4D imaging radars early this year. 4D imaging radars bring a significant performance boost compared to the previous generation of radars with a 16x increase in resolution*. The conventional tier-one suppliers achieve this by using four radar chips rather than the single chip found in incumbent models. For the consumer, this will translate to smoother, more effective ADAS features, improving their experience and, most importantly, improving the functionality of safety features like automatic emergency braking. So far, vehicles that have been fitted with 4D imaging radars include the BMX iX, which uses the ARS540 model from Continental, and the Chinese Feifan R7, which uses a model from ZF.

4D imaging radars are a big step in enabling higher-performing autonomous features for consumer vehicles. However, another technology is also arriving, which has been touted as a game changer for years but has simply been too expensive. LiDAR has finally reached a price point where OEMs are prepared to start integrating it, and there has been a flurry of model adoption announcements this year. 2023 could then be the year of the LiDAR.

Trends in automotive LiDAR

LiDAR is not a new technology. It is not quite as old as radar, but it might be surprising to learn it has been around since the 1960s. The first versions were simple and initially used for ranging applications in aerospace and defence. As the development and applications increased, LiDAR grew the ability to measure angles, velocity and produce detailed 3D maps, but the equipment was costly. The benefits for automotive were clear in the 2000s. It could offer the abilities of radar at a much higher resolution. However, until recently, it was simply too expensive for widespread adoption across the automotive industry.

The last year or so seems to have been a turning point for LiDAR, with more and more OEMs announcing models that will be equipped with them. Volvo will be using Luminar along with Chinese OEM SAIC. Continental and Denso are shipping on Toyotas and Lexus. The Audi A8 carries a Valeo, as do some Mercedes. BMW have chosen Innoviz, as have Volkswagen, and the list goes on. These examples are mainly premium vehicles so far; however, the automotive industry has a well-demonstrated trickle-down effect, with flagship technologies spreading down the price points over a period of 5-15 years. With the automotive industry’s current focus on safety and the benefits that LiDAR has been promising, this trickle-down effect might look more like a gush/pour/stream/cascade than a trickle.

Three predictions for 2023

With all the excitement over the past year and the promise for the future, here are three predictions from IDTechEx for 2023.

1. Robotaxi service expansion:

There are now a small handful of robotaxi services coming online in the US. Next year this will grow. It is unlikely that many new cities will go online; a few will, but the services in existing cities will grow –particularly Cruise in San Francisco, which will be a key service to keep track of.

2. Commercial ‘driver-out’ autonomous trucking will enter a trialling phase: IDTechEx thinks that in 2023 the first commercial autonomous truck routes without a driver behind the wheel will go online. This will likely start with a single route, perhaps Tucson to Phoenix, as demonstrated by TuSimple. However, IDTechEx thinks a handful of routes and companies will be online by the end of next year.

3. More level three vehicles in Europe enabled by higher performing radar and LiDAR:

So far, there has only been one true level three car on the market, the Mercedes S-Class. However, its level three functionality could only be used in Germany. IDTechEx thinks that next year more OEMs will be looking to deploy level three vehicles such as BMW, Stellantis, and perhaps more Mercedes models. Additionally, the UK and some European countries will likely allow level three to be used on their roads. In Germany, there may be the level three speed limit increase from 60kph to 130kph thanks to a UNECE regulation change coming into effect in January. Level three in the US and China is harder to predict as the relevant governing bodies have been as forthcoming or transparent as UNECE on a plan to make it happen. These regions have some of the most pioneering OEMs; they pushed the bounds of what is possible and are lobbying for more regulation around higher automated level deployments. IDTechEx does not think it will be long before deployments are seen here as well.